5,000,000 bloody nickels

The next stage of your “7 Deadly Sins of Today’s Stock Market” tutorial is here.

And George Noble calls it:

Buy When There's Blood in the Centrifuge: How Dispersion Creates Alpha

And like a lot of topics, he has a unique way of bringing together theory & practice in the way he describes it.

So I thought you might enjoy getting things straight from the horse's mouth today.

Which you will! But first, we need to meet George's co-star in the video you're about to see. He's recently become "internet-famous." For the giving the following unorthodox asset allocation advice:

They are literally telling you they're going to spend trillions of dollars by the end of the decade building data centers.

— 🏴☠️ (@calvinfroedge) October 19, 2025

What's the #1 ingredient in a data center? COPPER.

Instead of speculating on AI stocks, acquire thousands of tons of US nickels.

MAKE THEM PAY YOU pic.twitter.com/VSOureQqN2

And George took notice of this, because it's such a great example of dispersion creating alpha.

I'm sure you're familiar with the phrase "buy when there's blood in the streets."

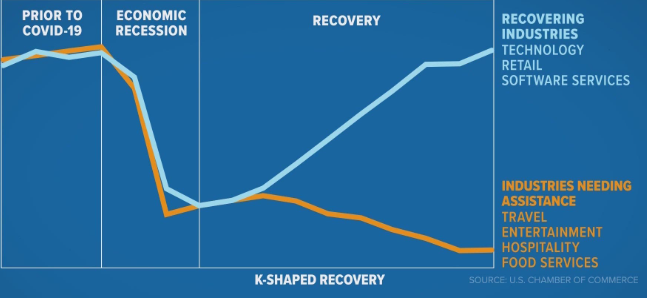

But not all market downturns are general, or obvious. Some are K-shaped, as certain assets take off wildly upwards... while others underperform. Sound familiar?

The two pronged K-Shape is just one example of a dispersion pattern.

Back when George was working at Fidelity with Peter Lynch, and launching his first legendary #1 fund, high dispersion patterns like this are what the old hands called "a stock-pickers market."

In other words... when everything is winning (like in 2021), we all look like geniuses. And when everything is losing (like in 2008) we all look like idiots.

But at a time when some stocks and sectors are winning but others are losing... you can see who's actually smart.

Can you spot the K-shape here?

These kinds of markets are filled with opportunities if you know where to look, and you're willing to be a bit unorthodox in your thinking.

... like a centrifuge that's spinning the blood (losing picks) apart from the plasma (winning picks).

(Maybe this metaphor hits harder if you've ever had a plasma infusion for an aching knee, shoulder, or ankle. And maybe I should try to fall down less when I'm mountain climbing. But I digress.)

That post pandemic K-shape we all know from a few years back, has led us to today's market. Which is dominated by a new, three pronged dispersion pattern:

It's this last category that George is most interested in for his webinar on Friday December 12th at 12:12pm EST.

Remember:

He's going to reveal his #1 Flame-Proof Trade for the New Year by the end. And then send you a complete report with all of his research on it.

That's why this isn't just the kind of "roast" where George will mercilessly poke fun at his favorite Wall Street targets.

(Who richly deserve it, for leading you down the path of deadly sin... like buying the wrong half of a K-shaped dispersion. Or buying with an eye to the last dispersion instead of the next one.)

It's also the kind of "roast"... where you eat well from what he's specially prepared, and leave fully satisfied.

A quick word of reassurance here. George will NOT recommend that you buy a shipping crate full of 5 million nickels... like an even more adventurous Twitter/X poster claims to have done.

But the trading idea he'll share on Friday is actually in this same general ballpark.

Which is why I thought it would be a good idea for you to watch George's interview with Calvin Froedge today. All about this quirky dispersion play, and why it could be a great way to create alpha, i.e. investing profit in excess of the market benchmark:

I hope you enjoy it.

And I'll see you back here in your email inbox tomorrow to discuss our next “deadly sin” topic:

3. Gas Station Sushi: The Race to “Democratize” Your 401(k)

P.S. In case you missed it here's our introduction and email tutorial #1.