IPO'calypse Now [your top 10 Q&A for George]

George Noble's advice to me about preparing today's Deadly Sins of Today's Market tutorial for you was simple:

"Don't be boring."

Because you can be sure that's the one thing he won't be at his upcoming webinar on Friday December 12th at 12:12pm EST:

Talk about a tough boss!

Maybe running the world's best-performing dividend newsletter, which beat the stock market 10-out-of-10 years in a row, isn't a good enough qualification to host an event for this investing legend.

(Although in my defense, my publisher at the time was The Motley Fool. Which sounds a lot less boring than Fidelity Funds, Mr. Noble. And I didn't include a "meme GIF" of Homer Simpson arguing with the Loch Ness monster at a casino the other day to impress my friends with accounting Ph.D.'s.)

That said... I think George is right.

Variety is the spice of life, and perhaps life is just one big roast where we laugh at all the cheaters and toast all the mensches.

So instead of an essay or video today, let's tackle the topic head-on by directly answering your fellow Roasters' most frequently asked questions about today's topic:

IPO'calypse Now: Why This New Wave Is the Worst Yet

As always, George will have a LOT more to say when he steps up to the microphone at his webinar on December 12th at 12:12pm EST:

Including naming & shaming a slew of specific IPO's that you're quite likely to see celebrated & promoted in 2026.

So our questions today will start with the usual reasons to wrestle down your "fear of missing out"... but then zero in on the specific new problems with the latest wave of IPO's.

- What is an IPO?

Those letters stand for "initial public offering."

- Where is an IPO?

Everywhere. The company is now offering its shares under S.E.C. law on the general market for the first time for anyone to buy – with no special personal qualifications or requirements – and pledging to adhere to public accounting requirements under penalty of law. (We saw why that last part is so important yesterday.) Which also puts it in compliance with the rules of the major stock exchanges, and makes it eligible to be listed.

- Why is an IPO?

Mainly because companies want to grow, and it's the best way to raise a &%^* ton of money very fast. At least, this was the prevailing reason for almost a century. But these days, private "unicorns" can access billions of dollars in venture capital before ever going public.

And as George has observed, this means they may have a new reason for IPO... to cash out their illiquid private shares with your liquid public money, at a point where they may have already massively saturated their customer market and solved most of their scaling problems. Does that start to sound like a new form of "gas station sushi" to you?

- When is an IPO?

To expand on my previous thought, we might say it's both too late and too early. It's too late for you to access the kind of protections that powerful private investors get in exchange for lock-ups and translucent data disclosure. But it's too early for the public market to purge its "irrational exuberance" and settle on a price that truly captures the company's forward growth expectations.

More on both of these thoughts below...

- Who is an IPO?

Let's take Facebook (a.k.a. META) as an example. It was already a household name at its IPO, and it was already close to cornering a duopoly on the advertising market in combination with Google. But it was still used by more college students than grandmothers at the time, and by more desktop computers than mobile phones. As always, the drumbeat of the IPO was "fear of missing out" on this today-fully-realized future.

Which is how Facebook's private venture partners in Silicon Valley, like Accel, Greylock, and Meritech likely pocketed a 100,000% ballpark gain the morning of its IPO. But remember, those deals weren't accessible to you... and those VC's also wrote off hundreds of other such early-bird investments that failed. For what it's worth, Facebook's earliest angel investors, like Peter Thiel, and its earliest owner-operators, like CEO Mark Zuckerberg, made even more. Probably double the Series-A venture capital return.

- How is an IPO?

It can be a rocky ride.

The Facebook IPO was notorious for being so oversubscribed that the NASDAQ computer system glitched, leading to an unthinkable 30-minute delay in a trading world that runs in nano-seconds. The listed IPO price was $38... in practice, you will never actually see or pay this price because the action happens so instaneously. It briefly traded above $43. At that point it starting free-falling, but the underwriters of the IPO stepped in to head off a public relations disaster and artificially keep it at $38 until the closing bell. (Some guys named Morgan Stanley, J.P. Morgan, Goldman Sachs, Bank of America, and Barclays. I'm sure they had very pure motives.)

Of course, all the king's bankers can't unbreak the eggs in this kind of undercooked omelette for very long. Facebook was trading at less than $26 within weeks and less than $18 – down by more than half — within months. And this is a pretty common story.

- Can an IPO have too much transparency?

Surprisingly, yes. Remember what we learned about the lack of transparency in private equity contracts? And how due to S.E.C. law, relatively more due diligence comes to light when stocks go public? Well it turns out that the disclosure burden of an IPO is even higher than that of an already-issued stock. They're required to file a document called an S-1 statement, going over every aspect of their business with a fine-toothed comb and enumerating every single possible thing that could go wrong. Then they go on a "road show" where the big institutional investors that drive the stock market get a chance to pick holes in their logic.

And that doesn't sound like a problem. But as Sherlock Holmes said in his most recent movie, "It's so overt, it's covert." And as Steve Bannon said, "Flood the zone." Sometimes more data, coming at us more quickly, puts us in a worse decision making posture than less data coming at us less quickly. Don't believe me? Read the next question below.

- Will I get another chance if I don't buy the IPO?

Naturally every case differs. But the point we're seeing here is that we need to separate our prediction about the company's long-term future from our prediction about the short-term behavior of other traders on the IPO day. In other words, George's advice to "never invest in an IPO" should not be equated to "never invest in a newer public company."

Imagine if you'd just done literally nothing while everyone was losing their minds (and their shirts) on the Facebook IPO. Then scooped it up at that low of $17.73. It's well above $600 a share today! And that's after sliding off its all-time high around $750 a few months ago. We're talking about 3,000% gains, or more.

But nobody's perfect. So instead of magically timing the bottom, what if you just bought it when it finally crawled back its day-one issue price again... more than a year after the IPO happened. You'd have a "meager" gain today of 1652.63%.

- Tell me the best and worst IPO's in recent history?

Both AirBNB and Snowflake better than doubled on their respective IPO days in 2020. But guess what? You can still buy them for lower than that price today.

In dollar terms, the Uber IPO in 2019 is the worst... it shed two-thirds of a billion dollars in market capitalization within hours. And, like Facebook, it took more than a year to even reach its issue price again. In percentage terms, FunkPop lost more than 40% on its IPO day in 2018.

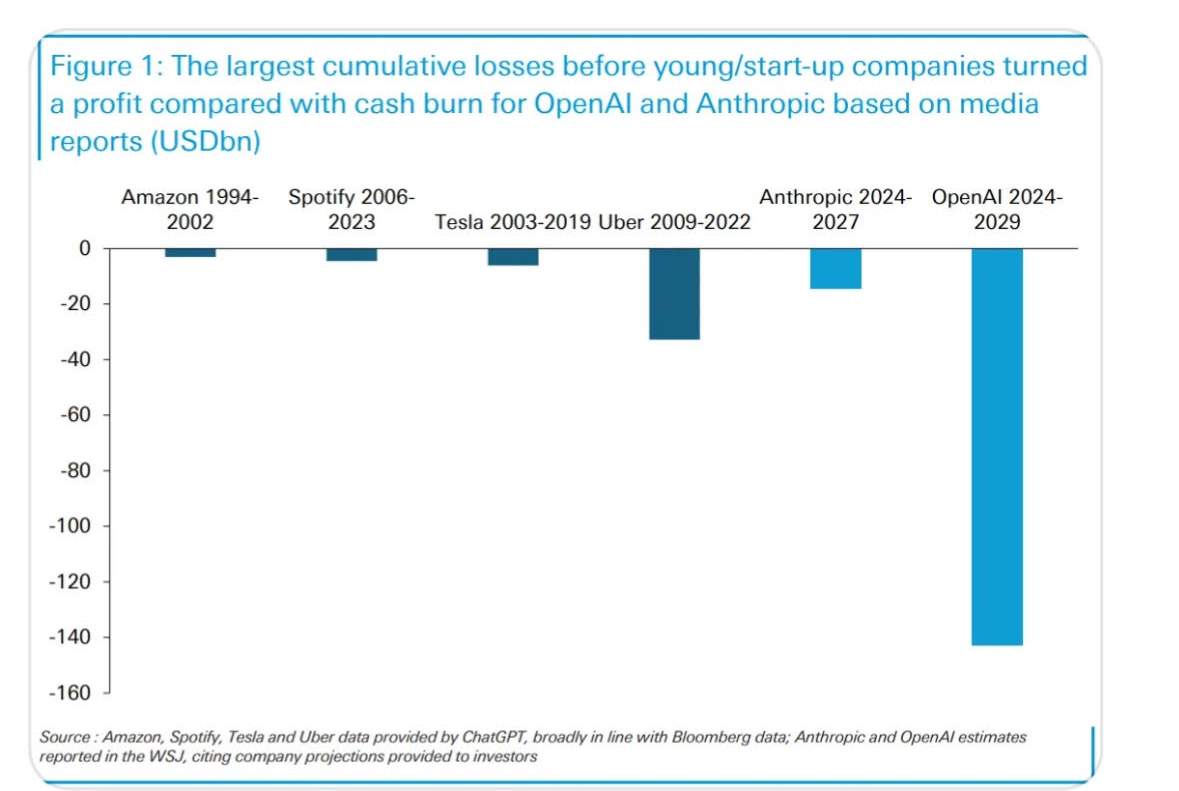

But then again, maybe the worst is yet to come. Per FT Alphaville:

- What if I have another question about IPO's for George, or a different question for him altogether?

That would be great! He's busy preparing for the big Roast right now... but I know he'd love to answer when he goes live.

So for convenience, please email me your questions for George to my own inbox at:

And see you back here tomorrow for:

Let Them Eat Stock: Why the Ticker Will Never Be the Product

P.S. In case you missed it here's #0... #1... #2... and #3 in our series.