They don't love you like that 💔

Dear Fellow Roaster,

Stocks are complex and unpredictable animals. Sometimes they bark at you like a dog, sometimes they scratch you like a cat, and sometimes they just poop on your carpet.

And unlike those lovable-anyway pets... the stock market doesn't care about you, and doesn't "owe" you its obedience.

That said, there are a few market principles that are still true more often than not.

For example, let me show you a chart that George Noble just passed along to us.

(How cool is it that you & me are now "pen-pals" with the guy who ran America's #1 mutual fund, and then two billion-dollar hedge funds?)

On to the chart.

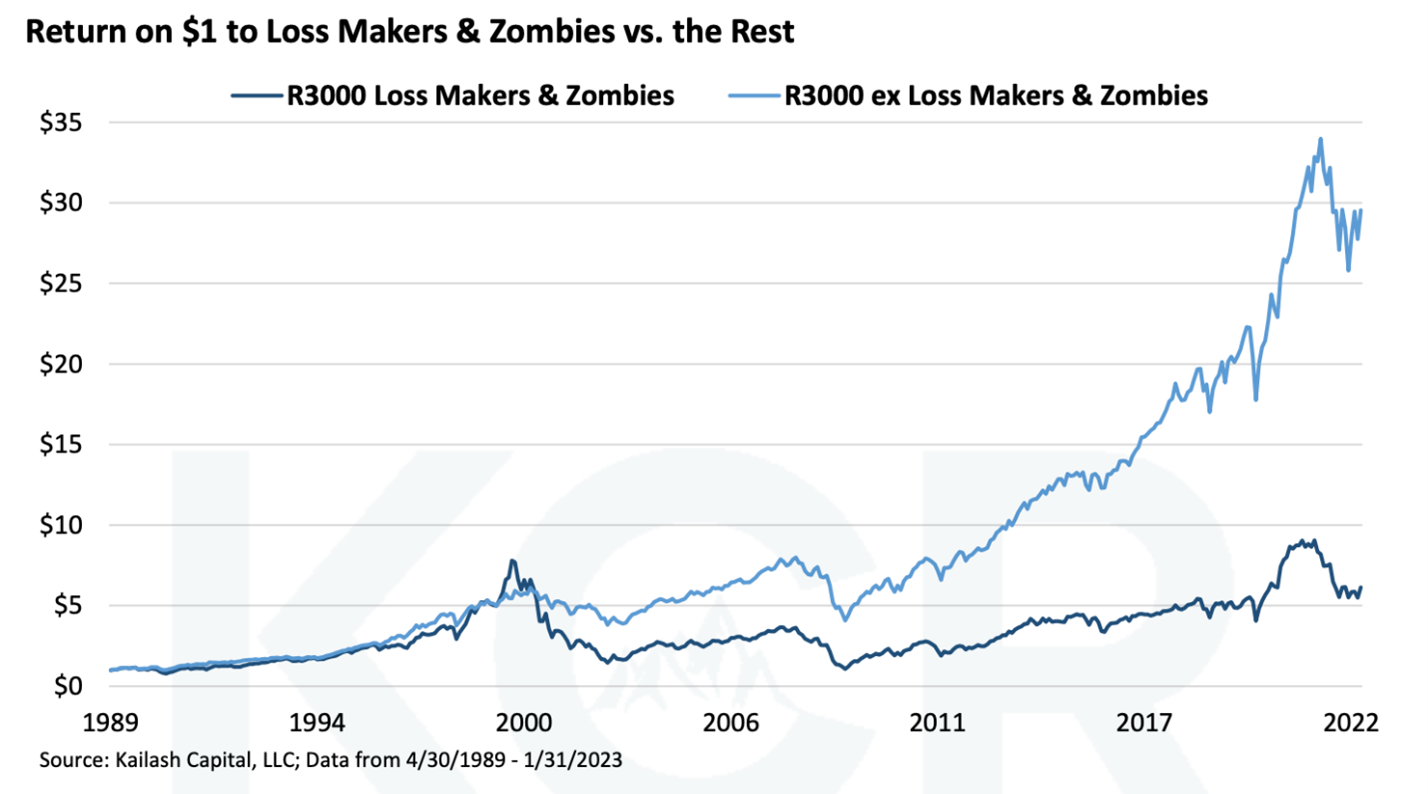

If you were to simply avoid stocks that publicly report negative total income – "loss-makers" – and the ones that publicly report interest expenses higher than their operating income – "zombies" – then just throw darts completely blind at everything else –

These would be your results.

You can learn a lot from this chart.

- As you can see, the light-blue line rockets way about the dark-blue line. Because this is a really good investing rule! I know George personally uses it.

- Although this study cuts off in 2023, we checked and the long-term trend still holds today.

- But look how the trend temporarily failed in 2000. You remember why – the dot.com bubble. So if you were to limit this analysis just to 2024-25 you might see a similar bubbly phenomenon. Loss-making is currently very stylish on Wall Street, and meanwhile there are tons of zombies; yesterday we called that a K-shaped dispersion pattern.

- Now notice what I just said about "publicly reported" losses. We may rightfully complain about the games that corporate CFO's play with their earnings reports & conference calls, especially all the important stuff they find a way to leave out. (A theme we'll return to tomorrow when we discuss our IPO topic, and later this week when we discuss accounting chicanery.) Nevertheless public means public. They are required by S.E.C. law to report their company income statement, cashflow statement, and balance sheet every 91 days. And that law exists because of a little thing called the Great Depression.

- So imagine a special situation – not back in the lawless age before the Great Depression with no required reporting transparency – but happening literally right now – where a corporate CFO – and maybe it's a really big corporation doing billions in revenue – might not be required at all to make these routine, transparent public reports.

In other words:

A company wants to offer you its stock.

But it's not actually required to tell you much of anything about how its business is performing.

Oh, and also:

Unlike the public stock market, in this special case you can't just sell your shares to the next guy if you change your mind. Because they're "locked up" by contract – often for years. And you don't control when they "unlock," if it ever happens at all.

Obviously, you would never buy that stock in a million years.

Because there's no way that Corporate America's marketing hucksters could find a compelling enough label for this bum deal that would get any Average Joe investor to ever be interested in it:

And even if they did, there's no way that Wall Street and its army of lobbyists could ever figure out how to make it legal:

Oops.

Turns out the lack of reporting transparency is just fine because you're getting "elite access to the kinds of private equity, venture capital, and real estate investments that were previously limited to only America's wealthiest investors."

And it turns out those lock-ups are good because they "align the goals of long-term oriented investors with long-term oriented corporate managers."

If your common sense says this is literally too good to be true...

Ding, ding, ding.

Because, just as a total coincidence here:

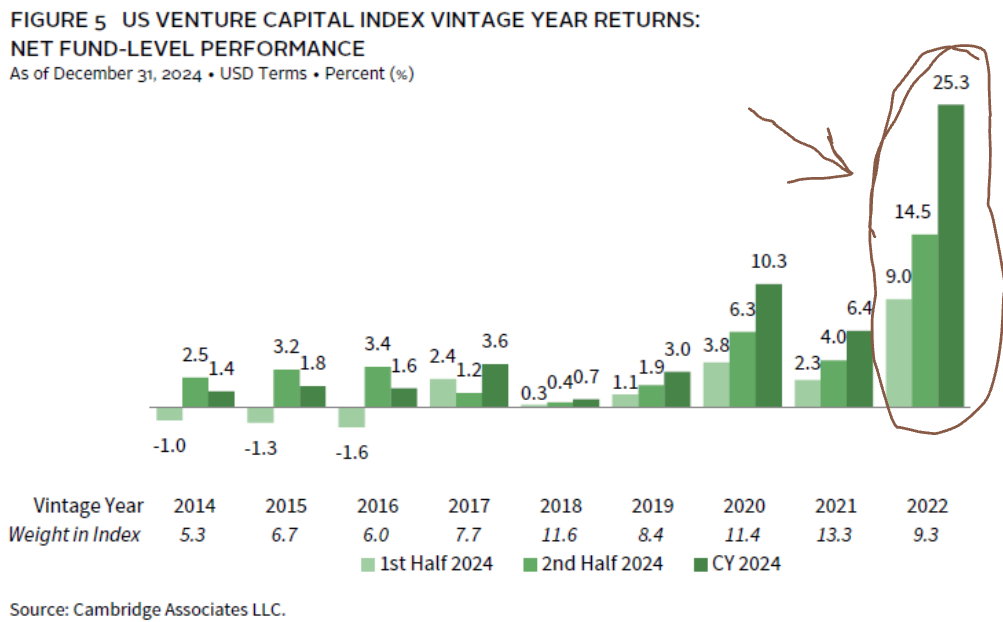

Many of America's wealthiest, who are now enthusiastically inviting you into their private party for the first time ever, out of the profound goodness of their hearts and their sincere desire to empower your dreams...

... have themselves just cleared the lock-up period from one of their biggest bumper crop profits of all time:

Can you see why George wanted to call today's "deadly sin" topic:

Gas Station Sushi: The Race to “Democratize” Your 401(k)

Plain and simple, they're trying to dump last night's fine dining leftovers on your table.

After they're already spoiled.

It's shameless – because not only is Wall Street aiming to buy low and sell high here, and on unfair terms, as always – but it seems that they'd like to make this arrangement permanent.

Perhaps given enough marketing & lobbying effort, it MIGHT eventually be possible to get everyone used to the idea that investors are NOT entitled to public earnings disclosures, and should NOT expect them.

We already saw this with the boom (and predictable bust) of all the SPAC's in 2020 and 2021.

Which was a way for Wall Street to bundle opaque private accounting practices inside nominally transparent publicly reporting entities.

By 2023: Only 5% of these dodgy investments were even neutral to their original issue price, while 95% went down in flames.

That's why George says:

And that's George he also shared this legendary gem from his favorite economist named Marx.

Not Karl Marx, who wrote the Communist Manifesto. He's talking about Groucho Marx, who starred with his brothers in Duck Soup and A Night at the Opera.

Groucho was invited to join the Friars Club, an elite Hollywood social establishment. Until he sent a response letter declining the invitation. As he told the story in his memoir, Groucho and Me:

George will have a LOT more to say about this "gas station sushi" at his webinar event on Friday December 12th at 12:12pm EST.

He'll tell you exact what to AVOID – and exactly what to focus your attention and money on instead.

In the meantime...

I'll see you back here in your email inbox tomorrow to discuss our next "deadly sin" topic:

IPO'calypse Now: Why This New Wave Is the Worst Yet

P.S. In case you missed it here's #0... #1... and #2 in our series.