🎁 Your first gift from George Noble

Thanks again for signing up for this series with us.

This is the first of your free “7 Deadly Sins of Today’s Stock Market” tutorials...

You’ll get more of these emails from us throughout the week. As we all get ready for the main event on Friday December 12th at 12:12pm EST:

As the saying goes, “time in the market beats timing the market.”

So having this extra time together to learn from America’s #1 fund manager is a gift in its own right.

George is busy preparing for the show today, so I'll get the ball rolling for you. (You'll hear from him directly in just a minute.)

As promised, today’s topic is:

It’s Raining Weathermen: The Noble Art of Ignoring Macro Forecasts

And if you’ve turned on your TV today, or opened up a web browser, you might know exactly what George means when he phrased it that way.

Think back to the ancient days…

Just a few decades ago.

Around the time that George was first working with the legendary Peter Lynch at the Fidelity Magellan Fund.

(And eventually his own Fidelity Overseas Fund… which returned an average profit of +27.5% annually during the time he was in charge.)

Back then, when we wanted to know what was driving the market, we had the business section to the daily city newspaper, The Wall Street Journal, and maybe a weekly magazine like Barron’s, Kiplinger’s, or Forbes.

That’s a world with no cable TV, no internet, and no Bloomberg terminals. It’s almost unthinkable today, even if you were there.

Yet it was a world that ran on most of the same raw data we still use today.

Stock prices. Quarterly and annual company earnings reports.

And government sources like the annual Treasury Report, the annual Council of Economic Advisors report, the monthly Federal Reserve bulletin, and the monthly labor report from the Bureau of Labor Statistics.

So what’s changed?

We do have a limited degree of new “alternative” data that was never available before… things like satellite imagery, website analytics, machine sensor data… even tracking programs that monitor where corporate jets are flying certain executives to.

But that’s just a few drops in a mighty flood.

Because what we have even more of now, and more & more every day, is not data at all – but commentary, opinions, and forecasts.

About all manner of macroeconomic phenomena. Interest rates, tariffs, inflation, currency rates, consumer behavior, etc. Plus the price of key stock indices and commodity assets.

Along with commentary about commentary, opinions about opinions, and forecasts about forecasts, layered to the Nth degree.

We even have access to “sentiment tracking analysis” that tries to create a mathematical model of what all of these gusting layers of hot air might be adding up to at any given time.

And brief gusts in one direction or another can indeed move the markets (temporarily), as traders react to the reactions of other people reacting to other reactions to perceived market sentiment. A phenomenon called market reflexivity.

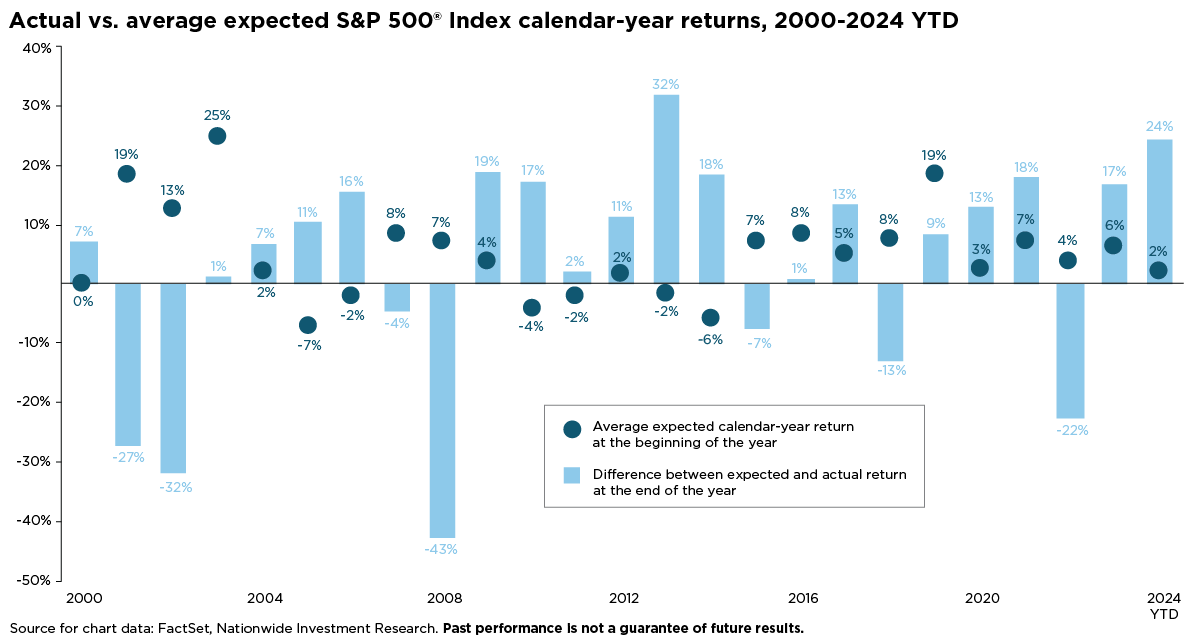

The sum this is, nobody actually knows anything. Don't believe me?

Wrong wrong wrong, year after year. They might as well be throwing darts blindfolded.

Which leads us to the key question…

Does any of this actually make us better informed, or better able to make choices that help grow our portfolio?

Obviously not.

Why does this happen?

Mechanically, for the usual, all-too-human reasons…

Main Street investors get too greedy in upswings and buy high, then panic in downturns and sell low.

But that’s a tale as old as time.

(Did you know that securities trading was invented 5,000 years ago in Ancient Mesopotamia?)

The specific challenge that small investors face today stems from the problem of ubiquitous forecasting “data” and the feeling of false certainty it produces.

And this “sin” is what leads to false confidence in trading – often at the worst possible time, in a way that too often confirms your preexisting emotional biases.

Meanwhile, this fog of false certainty produces distraction about what really matters – your own investing goals & time horizon, and the longer term prospects of the stocks or assets you’re actually trading.

And it’s obvious what the root cause is here. Financial media is a business, like any other. And that business runs on the fuel of viewing time and “clicks.”

So the more talking heads squawk about the latest forecasts, and what they must mean, the better their particular business performs. (And the worse your portfolio performs.)

Just pay attention to all of the forecasts you’re about to hear about how the market will perform in 2026.

Then notice how none of those forecasters has a thing to say about whether their forecast for 2025 turned out to be accurate. And notice how they’ll all change their tune later next year to claim that it was “obvious” that whatever actually happened, was going to happen – even when contrary to their original predictions.

We asked George for some of his favorite wisdom about this deadly sin and he shared the following:

Then we asked him to give a recent example to illustrate this lesson.

And that’s when George raised an entirely new point that I hadn’t even considered.

Long story short... don’t let someone else’s forecast be a distraction to your own process.

They might be right – but more likely not. And as George just showed, even if they are right about what they’ve specifically predicted, they might not be right about it implies, or why it actually matters to you.

George will come back to that same idea next Friday at his “roast”... he’s building research on a perfect example that’s playing out in the markets right now.

(Which is creating an excellent fast-action opportunity for investors like us.)

Meanwhile, we’ll be back here in your email inbox tomorrow to discuss our next “deadly sin” topic:

Let Them Eat Stock: Why The Ticker Will Never Be the Product

Until then...

P.S. In case you missed it, here's our full introduction to the holiday roast.